Hydraulics Market Size, Share, Trends and Growth

Hydraulics Market by Type (Mobile, Industrial), Component (Cylinders, Valves, Pumps, Motors, Filters, Accumulators, Transmissions), Sensor (Position, Pressure, Temperature), End-use Industry (Construction, Agriculture) and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global hydraulics market, valued at USD 38.98 billion in 2024, is projected to reach USD 44.26 billion by 2030, reflecting a CAGR of 2.4%. Market growth is driven by strong construction activity, rising demand for material handling and advanced agricultural equipment, and increasing adoption of hydraulic technologies across industrial sectors, highlighting their strategic importance in improving operational efficiency and productivity.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific hydraulics market accounted for a 38.4% revenue share in 2024.

-

By TypeBy Type, the mobile segment is expected to register the highest CAGR of 2.6%.

-

By ComponentBy Component, the cylinders segment is projected to grow at the fastest rate from 2025 to 2030.

-

By SensorBy Sensor, the pressure sensors segment is projected to grow at the fastest rate from 2025 to 2030.

-

By End-use IndustryBy End-use Industry, the construction segment is expected to register the largest market share during the forecast period.

The global hydraulic market is shifting from traditional systems to intelligent, technology-driven solutions. Innovations such as IoT-enabled hydraulics, AI-based predictive maintenance, and energy-efficient components are being adopted across various sectors, including construction, automotive, aerospace, mining, and energy. These smart systems enhance efficiency, safety, and productivity while reducing downtime, driving strong demand for connected and high-performance hydraulic solutions worldwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses in the hydraulics market is being reshaped by the shift from conventional hydraulic systems to advanced, technology-driven solutions. Innovations such as IoT-enabled hydraulics, AI-based predictive maintenance, smart sensors, 5G technology, and others are transforming operations across various industries, including construction, aerospace, agriculture, material handling, oil & gas, automotive, and mining. This technological evolution is driving demand for smart, connected, and high-performance hydraulic systems, enhancing operational efficiency, reliability, and safety while minimizing downtime and maintenance costs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising need for more compact hydraulic components and systems

-

Increasing demand for smart hydraulic systems

Level

-

High manufacturing and maintenance costs

-

Complexities associated with the maintenance of hydraulic equipment

Level

-

Surging adoption of lifting equipment in the shipping industry

-

Continuous R&D and technological advancements in hydraulic cylinders

Level

-

Availability of substitute products

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising need for more compact hydraulic components and systems

The growing demand for compact hydraulic systems is driving the hydraulics market, as industries like construction, aerospace, agriculture, and material handling adopt equipment with smaller footprints. These systems offer high performance in limited space, reduced weight, lower energy consumption, and easier installation. Advancements in miniaturized actuators and integrated valves enhance functionality, supporting mobile and automated machinery. Rising focus on efficiency, versatility, and cost reduction is fueling continued growth in compact hydraulic solutions.

Restraint: High manufacturing and maintenance costs

The manufacture of hydraulic equipment demands precise engineering and metal forging, creating high entry costs for SMEs. Beyond initial investment, ongoing maintenance adds to expenses, as components like cylinder rods and tubes require regular inspection. Issues such as bent rods, incorrect dimensions, and worn cylinder walls (balloon tubes) can cause failures and load shifts. These maintenance challenges and associated costs act as key restraints on hydraulics adoption.

Opportunity: Surging adoption of lifting equipment in the shipping industry

Dockyards handle shipping containers of various sizes and weights, often stacked hundreds of feet high. With global trade relying heavily on shipping for goods like electronics, automobiles, textiles, and raw materials, lifting equipment is essential. Growing government support, technological adoption, and port infrastructure development are driving the shipping industry, boosting demand for hydraulic cylinders. Though adoption of such equipment is still early, it is expected to rise significantly in the coming years.

Challenge: Availability of substitute products

Hydraulic systems rely on fluid, mainly oil, and leaks can contaminate the environment. Industries requiring clean operations often prefer pneumatic systems, which use compressed gas to generate force and pose no contamination risk. In applications like agriculture and material handling, where personnel work nearby, cleaner alternatives are essential. The availability of such pneumatic systems presents a key challenge to the growth of the hydraulics market.

Hydraulics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Bosch Rexroth’s Hägglunds division upgraded Stahl’s hydraulic drive systems with an energy-efficient design and new power units to replace aging components. | Delivered 15% overall energy savings, lowered operating costs, and strengthened sustainability performance. |

|

Rotec designed a self-contained hydraulic system for a grain ship loader gantry, replacing an obsolete and fire-damaged setup with a high-efficiency containerized solution. | Restored continuous port operations, ensured long-term system reliability, and improved safety standards. |

|

SMC delivered a custom hydraulic power unit for a seamless-tube production line expansion within a short commissioning timeline. | Enabled on-time start-up, minimized production downtime, and improved system reliability. |

|

Danfoss supplied over 500 hydraulic systems for Alstom’s high-speed tilting trains to enhance motion control and braking performance. | Increased train stability, reduced maintenance time, and improved operational efficiency. |

|

Bosch Rexroth modernized an old extrusion press with a high-efficiency pump and control manifold system. | Achieved 14% higher output, reduced energy use, and extended equipment life. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The hydraulics market ecosystem consists of component manufacturers (Bosch Rexroth, Parker, Danfoss), distributors (Parker, Larzep, Fluid Tech Hydraulics), and end users in construction (Skanska, Vinci), automotive (Mercedes, Toyota), shipping & material handling (Maersk), mining (BHP, Rio Tinto), and aerospace (Boeing, Airbus). Component manufacturers supply critical parts such as pumps, valves, and cylinders, while distributors ensure efficient delivery, customization, and aftermarket support. Key end users drive demand for reliable, high-performance hydraulic systems in heavy lifting, precision control, and industrial automation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hydraulics Market, By Type

As of 2024, the mobile type segment holds the largest share of the hydraulics market, driven by the widespread use of hydraulic cylinders in equipment such as excavators, loaders, and cranes. Hydraulics enable key applications in earthmoving, material handling, and mining. Growing industrialization and expanding construction activities are further fueling the demand for hydraulic cylinders in mobile equipment, making this segment a critical contributor to the overall growth of the hydraulics market.

Hydraulics Market, By Component

As of 2024, the cylinders segment represents the largest share of the hydraulics market, with wide-ranging applications across construction, aerospace, automotive, agriculture, mining, oil & gas, and marine industries. Companies are investing heavily in research and development to enhance cylinder performance and maintain competitiveness. A key innovation is the emergence of smart hydraulic cylinders, which integrate electronic components to improve precision, functionality, and controlled piston movements, delivering advanced and efficient solutions for diverse applications.

Hydraulics Market, By End-use Industry

As of 2024, the construction industry dominates the hydraulics market, driven by expanding infrastructure in emerging nations. Hydraulic cylinders are essential in machinery such as excavators, backhoes, dozers, motor graders, and road rollers, providing high load-bearing capacity, precise maneuvering, and reliable performance. The agricultural sector is also growing, with machinery like sprayer booms, automated bale trailers, and harvesters relying on hydraulics for lifting and movement control. Rising demand for food and advancements in precision agriculture are further fueling the need for hydraulic systems.

REGION

Asia Pacific to be fastest-growing region in global hydraulics market during forecast period

As of 2024, Asia Pacific is expected to hold the largest share of the hydraulics industry, driven by rising demand for agricultural, construction, and mining equipment. Growth is fueled by population expansion and industrialization in countries like India and China. Key markets include Japan, where automation addresses labor challenges in manufacturing, and India, where infrastructure development, easy financing, new product offerings, and regulatory support are accelerating the adoption of hydraulic systems across industries, boosting overall market growth in the region.

Hydraulics Market: COMPANY EVALUATION MATRIX

In the hydraulics companies matrix, Danfoss (Star) leads with a comprehensive portfolio of advanced hydraulic solutions, offering superior performance, precision control, and energy efficiency across industries such as construction, agriculture, automotive, and industrial machinery. Kawasaki (Emerging Leader) is rapidly strengthening its position by delivering innovative, compact, and high-performance hydraulic systems designed for modern industrial and mobile equipment, aligning with the growing demand for smart, sustainable, and connected hydraulic solutions worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 38.98 Billion |

| Market Forecast in 2030 (Value) | USD 44.26 Billion |

| Growth Rate | CAGR of 2.4% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

WHAT IS IN IT FOR YOU: Hydraulics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiling of key market participants with details on product portfolio, market share, technological advancements, and strategic collaborations across hydraulic system categories. | Enables benchmarking of competitive positioning and assessment of innovation and automation strategies. |

| Regional Market Entry Strategy | Country and region-specific insights covering infrastructure projects, industrial investments, and regulatory frameworks driving hydraulics adoption. | Supports informed regional expansion and strategic planning in high-growth industrial and mobile equipment markets. |

| Application-Specific Opportunity Assessment | Evaluation of adoption trends across construction, automotive, aerospace, agriculture, mining, and energy sectors. | Helps identify high-demand applications and prioritize product development and market focus. |

| Technology Adoption by End-use Industry | Insights into the integration of smart, IoT-enabled, and automated hydraulic systems for improved efficiency, precision, and predictive maintenance. | Guides R&D planning, technology upgrades, and differentiation through digital and smart hydraulic solutions. |

| Pricing & Margin Benchmarking | Analysis of hydraulics pricing by component (cylinders, pumps, valves), application, and end-user segment across OEM. | Supports pricing optimization, profitability improvement, and strategic decision-making in the hydraulics market. |

RECENT DEVELOPMENTS

- October 2024 : The KBFRG4-5 proportional valve is designed for high performance, offering a maximum pressure capacity of 350 bar and a flow rate of up to 290 liters per minute at 57 bar. It delivers greater power compared to many other valves currently available and ensures fast response times with a step response of 20 milliseconds.

- June 2024 : Danfoss introduced a new range of high-performance hydraulic remote controls built to perform reliably in extreme and demanding environments. The DHRC series enhances machine productivity by delivering precise control and improved operator comfort. With customizable and durable designs, the DHRC line offers high reliability and is engineered for ease of use, requiring minimal operator effort to maximize efficiency.

- February 2024 : Danfoss launched its comprehensive valve portfolio under the newly unified Integrated Circuit Solutions (ICS) range. This portfolio brings together cartridge valves and hydraulic integrated circuits from several legacy brands, creating one of the most extensive and versatile offerings in the market.

- February 2023 : Bosch Rexroth finalized the acquisition of HydraForce after obtaining clearance from antitrust authorities. HydraForce is set to become part of Bosch Rexroth's Compact Hydraulics portfolio, contributing significantly to the expansion of the business unit's product range and customer assistance. While both companies specialize in diverse compact hydraulic products, HydraForce's specialized knowledge in designing mechanical and electrical cartridge valves and hydraulic integrated circuits (HIC) will serve as a valuable addition, complementing the existing portfolio of Bosch Rexroth.

Table of Contents

Methodology

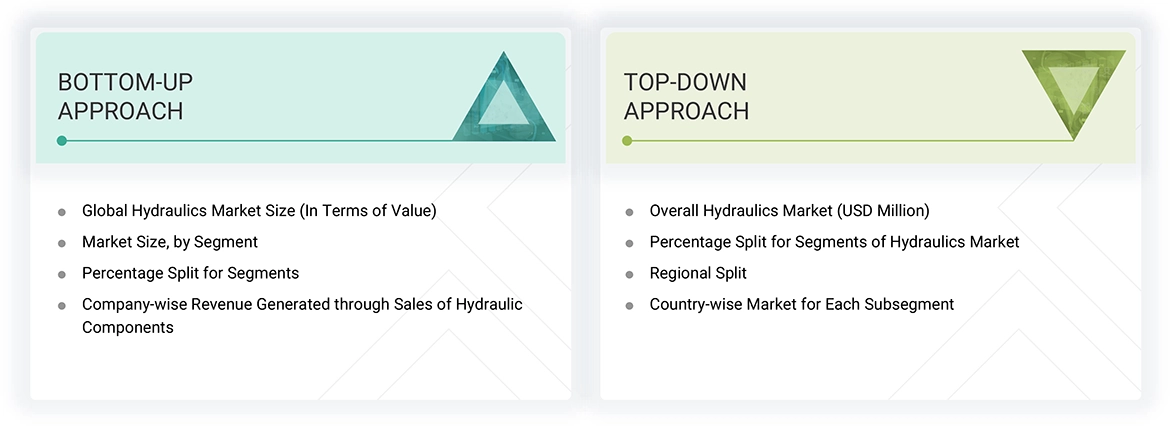

The study involved major activities in estimating the hydraulics market size. Exhaustive secondary research was done to collect information on the market under study. The next step was to validate these findings, assumptions, and sizing from industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were followed to estimate the size of the segments and subsegments of the hydraulics market.

Secondary Research

The revenue of companies offering components for hydraulic systems is calculated using secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating them by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, investor presentations of vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after understanding and analyzing the current scenario of the hydraulics market through secondary research. Several primary interviews were conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 30% of the primary interviews were conducted with the demand-side respondents, while approximately 70% were conducted with the supply-side respondents. The primary data was also collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary interview participants. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

Note: Others include vice presidents, senior managers, project managers, and analysts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the hydraulics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Hydraulics Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. Wherever applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Hydraulics is a mechanical system utilizing liquid pressure to generate, control, and transmit power. Hydraulic systems use fluid—usually oil or water—to perform tasks such as lifting, pressing, drilling, or moving mechanical components in machinery and equipment. These systems often employ cylinders to move pistons and generate force. They play a pivotal role in multiple industries, including construction, aerospace, and automotive, facilitating efficiency in moving loads. The technology's reliance on liquid power enables the execution of various mechanical actions across industrial and mobile equipment. Hydraulic machinery uses fluid power to generate, control, and transmit force, employing liquids to operate cranes, lifts, and excavators for various industrial applications.

Key Stakeholders

- End-use Industries

- Government bodies, venture capitalists, and private equity firms

- Hydraulic manufacturers

- Hydraulic distributors

- Hydraulic industry associations

- Professional service/solution providers

- Research institutions and organizations

- Standards organizations and regulatory authorities related to the hydraulics market

- System integrators

- Technology consultants

Report Objectives

- To define, describe, and forecast the global hydraulics market, by type, component, sensor, and end-use industries, in terms of value

- To describe and forecast the market for several countries in four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges that influence the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the hydraulic ecosystem, along with market trends and use cases

- To study includes US tariff and AI/Gen AI impact analyses, technology trends, average pricing, regulatory landscape, trends/disruptions impacting customer business, and key criteria for buying hydraulic components

- To analyze opportunities for stakeholders by identifying high-growth segments of the global hydraulics market

- To strategically profile key players and comprehensively analyze their core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as product launches, acquisitions, partnerships, and expansions, in the global hydraulics market

- To benchmark market players using the company evaluation matrix, which analyzes players based on various parameters with respect to business categories and product strategies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hydraulics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hydraulics Market